Understanding the Basics of ESG Investing

Tue, Aug 1, 2023

Read in 17 minutes

"Demystifying the essentials of ESG investing, this comprehensive guide will navigate you through its core principles, various strategies, assessment methodologies, and future trends in the realm of sustainable investment"

Introduction to ESG Investing

UStarting to invest in ESG can be exciting but also a bit scary. You’ve made up your mind to put your money into businesses that do good things for people and the planet. But you might be scratching your head, wondering what ESG investing really means. How do you pick the right investments? And how does caring about ESG make a difference to how much money you could make?

Don’t worry - it’s normal to have these questions and feelings. ESG investing is more than just making money. It’s about tying your money to your values and wanting to make the world a better place.

Getting to grips with ESG investing isn’t just about understanding money and markets. You also need to know about big world problems like climate change and inequality, and what role businesses play in these issues. That means looking at more than just a company’s profits. You’ll need to check out how they run their business, where their supplies come from, and how they treat their staff. It might seem like a lot, but each step you take helps you become an investor who’s aware of the impact you’re making. So, take a deep breath, get ready, and let’s dive into ESG investing together.

What is ESG Investing?

So, what is ESG investing? In simple terms, it’s a way to invest your money in companies that care about more than just making a profit. They also care about looking after our planet, treating people fairly, and running their business in an honest and open way. These are known as their Environmental, Social, and Governance (or ESG) factors.

Let’s use a real company to show what this means. Take Patagonia, a company famous for making outdoor clothing. Patagonia is a good example of an ESG company because it’s committed to looking after the environment and treating its workers well. This makes it a good pick for ESG investors who want to support businesses doing the right thing.

Why is ESG Investing Important?

Why should we bother with ESG investing? Well, many of us are becoming more worried about big problems like climate change, unfairness in society, and businesses not behaving properly. We want to do something about these issues. And one way to do it is through ESG investing.

When we invest in ESG companies, we are supporting businesses that are making a positive impact on these problems. And by doing so, we can also avoid investing in companies that may run into trouble because of these issues.

For example, think about a company like Tesla, which is leading the way in making cars that don’t use fossil fuels. By investing in Tesla, we’re helping to support a company that’s doing its part to fight climate change. That’s why ESG investing is so important.

The Increase in ESG Investing

More and more people are getting into ESG investing because they see that the way companies act on environmental, social, and governance issues can really impact how well they do in the long run.

Look at Unilever, for example. It’s a big company that makes all kinds of things and it’s put a lot of money into being more sustainable. This has helped it become a top choice for ESG investors. Not only has it gotten a better reputation, but it’s also been making good money. This shows how ESG investing can be a good move.

The Core Components of ESG Investing

So, what makes up ESG investing? It’s really about looking at three big things - how a company is helping (or hurting) the environment, how it treats people, and how it’s run.

The ‘E’ in ESG: Environmental Considerations

First off, the ‘E’ stands for ‘Environmental.’ This is about what a company is doing to protect our planet. Does it recycle? Is it careful not to pollute? Does it use energy wisely? Companies that pay attention to these things might be a good choice for ESG investors.

Let’s take a look at a real-world example.

Consider a company like Ikea, the popular furniture retailer. They’ve made it a goal to become ‘climate positive’ by 2030. This means they want to reduce more greenhouse gas emissions than the Ikea value chain emits, doing more good for the environment than harm. They plan to do this by increasing energy efficiency, using renewable energy, and making products that are more sustainable. For instance, they’ve started making furniture from recycled materials and even buy back used Ikea furniture to refurbish and resell, keeping it out of landfills.

So, when you think about the ‘E’ in ESG, imagine a company like Ikea that’s really trying to do right by our planet. If more and more companies follow this route, the environmental benefits could be significant. This is the kind of positive change ESG investors aim to support with their investment choices.

The ‘S’ in ESG: Social Factors

Then there’s the ‘S,’ which is for ‘Social.’ This involves how a company treats its employees and the people who live where it operates. Do workers get fair wages and safe conditions? Is the company respectful to local communities? Does it make sure its products are safe? These are all key social factors to consider.

Let’s bring in a practical example to illustrate this.

Think about the technology giant, Microsoft. They are often recognized for their efforts towards creating an inclusive work environment. For instance, they’ve implemented strategies to increase diversity and inclusiveness in their workforce, with a focus on attracting, hiring, and developing people from underrepresented backgrounds. Furthermore, they’ve committed to accessibility, with a mission to empower every person and every organization on the planet to achieve more, including over 1 billion people with disabilities.

In terms of their broader social impact, Microsoft also engages in various philanthropic activities, using technology to address societal challenges. For instance, they’ve leveraged their AI technology to help non-profit organizations solve humanitarian issues and improve human lives.

So when we think about the ‘S’ in ESG, envision a company like Microsoft that genuinely invests in its people and contributes positively to society. This shows us how ESG investing supports companies that prioritize the well-being of employees and the broader community.

The ‘G’ in ESG: Governance Principles

Lastly, ‘G’ stands for ‘Governance.’ This is about how a company is run. Is it transparent, sharing lots of information about its activities? Does it follow good business practices? Are there checks and balances in place to prevent corruption? A company that is well-run is usually a better risk, so governance is something ESG investors watch closely.

For example, consider a company like Johnson & Johnson, which is often lauded for its strong governance practices. It has a comprehensive corporate governance structure that promotes accountability and transparency. It has a clear separation of roles between its CEO and the Chairman of the Board, a move often viewed as a good governance practice as it helps prevent a concentration of power. Johnson & Johnson also has independent audit and nominating committees, which add another layer of oversight and ensure the Board’s independence from management.

Moreover, it has policies and systems in place to ensure ethical conduct. This includes their Credo, a mission statement which outlines their responsibilities to customers, employees, communities, and shareholders. Their strong governance principles have helped them earn the trust of stakeholders and build a resilient business.

When you’re thinking about the ‘G’ in ESG, picture a company like Johnson & Johnson that values transparency, accountability, and good business ethics. These robust governance structures make such companies more appealing to ESG investors.

That’s the basics of ESG investing. It might seem like a lot to think about, but over time you’ll get a feel for which companies are taking these issues seriously. And remember, when you invest in these companies, you’re using your money to encourage more businesses to do the right thing. That’s a win for you, a win for them, and a win for everyone!

ESG Investing Approaches

When it comes to ESG investing, there are a few different ways you can approach it. Think of it like eating at a buffet. Negative screening is like avoiding the deep-fried stuff - it’s about saying no to companies that don’t meet certain ESG standards. Positive screening, on the other hand, is like filling your plate with healthy foods - you’re actively looking for companies that shine in ESG areas.

Then there’s impact investing, which is like not just eating healthily, but also supporting the local farm that grows organic veggies. It’s about investing in companies that are making a positive environmental or social impact. Lastly, ESG integration is like making your entire diet about healthy eating. It’s a comprehensive approach where ESG considerations factor into every investment decision you make.

Each of these approaches has its own benefits and can guide you in making investment choices that align with your values and the kind of world you want to support. Let’s consider them in more details.

Negative Screening

Think of it as being at a party where everyone is wearing a hat. Negative screening is like deciding not to talk to anyone wearing a red hat because you’ve heard that people wearing red hats often tell boring stories. In ESG investing, it’s similar. You choose not to invest in companies or sectors that don’t meet certain environmental, social, or governance standards. It’s about saying no to these pre-selected companies or sectors. For example, some investors might choose to avoid businesses that have a heavy carbon footprint, like oil companies, or those involved in controversial activities, like weapons manufacturing.

As you’re avoiding those deep-fried options at the buffet and anyone wearing a red had, remember that doing negative screening also requires you to be well-informed. It’s crucial to do your homework and understand what you’re not putting on your plate. Get to know the sectors and companies you plan to avoid. This might mean researching companies' practices, staying updated on news about these industries, or using reliable ESG rating systems. Remember, the aim is to align your investments with your values, so the more you know about what you’re excluding, the better.

Positive Screening

There is one simple example how to explain positive screening.

Imagine you’re at a bookstore, and you’re specifically looking for books that have won literary awards. This is similar to positive screening in ESG investing. You’re actively seeking out companies that shine in their environmental, social, and governance practices. You might be drawn to a renewable energy company like Vestas, renowned for its sustainable business model and positive impact on the environment.

As for advice, positive screening is a proactive approach, but it requires thorough research to identify truly ESG-committed companies. It’s essential to look beyond surface-level claims and assess the company’s real impact. Reviewing annual sustainability reports, third-party assessments, and news about the company can help you make informed decisions. Remember, in ESG investing, it’s not just about whether the company is profitable but also how it’s making those profits.

Impact Investing

Let’s go back to our buffet. Imagine if, instead of just avoiding deep-fried foods or choosing healthy ones, you could invest in a farm that grows organic veggies. You’re not just avoiding the bad or choosing the good - you’re helping to create more good in the world. That’s what impact investing is like. It’s about putting money into companies or projects that are designed to make a positive environmental or social impact. Companies like already mentioned Patagonia, which has a clear mission to combat environmental crises, could be targets for impact investing.

As a different interesting example, consider a company like TOMS Shoes, for instance. For every pair of shoes sold, TOMS pledges to donate a pair to a child in need. This company’s business model is structured around creating a specific positive social impact, making it a fitting example of a target for impact investing.

When considering impact investing, you should think about what matters most to you. What kind of positive change do you want to support? Be it combating climate change, reducing inequality, or promoting education, find companies or projects that align with your values and are designed to make a difference in these areas.

ESG Integration

ESG Integration is like building an entire house with the focus on sustainability - using energy-efficient appliances, solar panels, and eco-friendly materials. It involves considering ESG factors in every single investment decision you make, not just a select few. This is a comprehensive approach where a company’s environmental impact, how it treats people, and how it’s governed are thought about every time you decide where to put your money.

For example, you might consider a company like Google. It has set ambitious environmental goals, including its commitment to become carbon negative by 2030. It’s also highly rated for its governance and treatment of employees. When using ESG Integration, look for companies like this, where sustainability and fair practices are ingrained into their very blueprint. It’s not just about individual “green” projects, but an overarching commitment to ESG principles across their entire operation.

Assessing ESG Investments

So finally, you’ve decided that ESG investing is a good path for you - but where do you start? What challenges should you expect in ESG investing, and how important is ESG disclosure and transparency to you as an ESG investor?

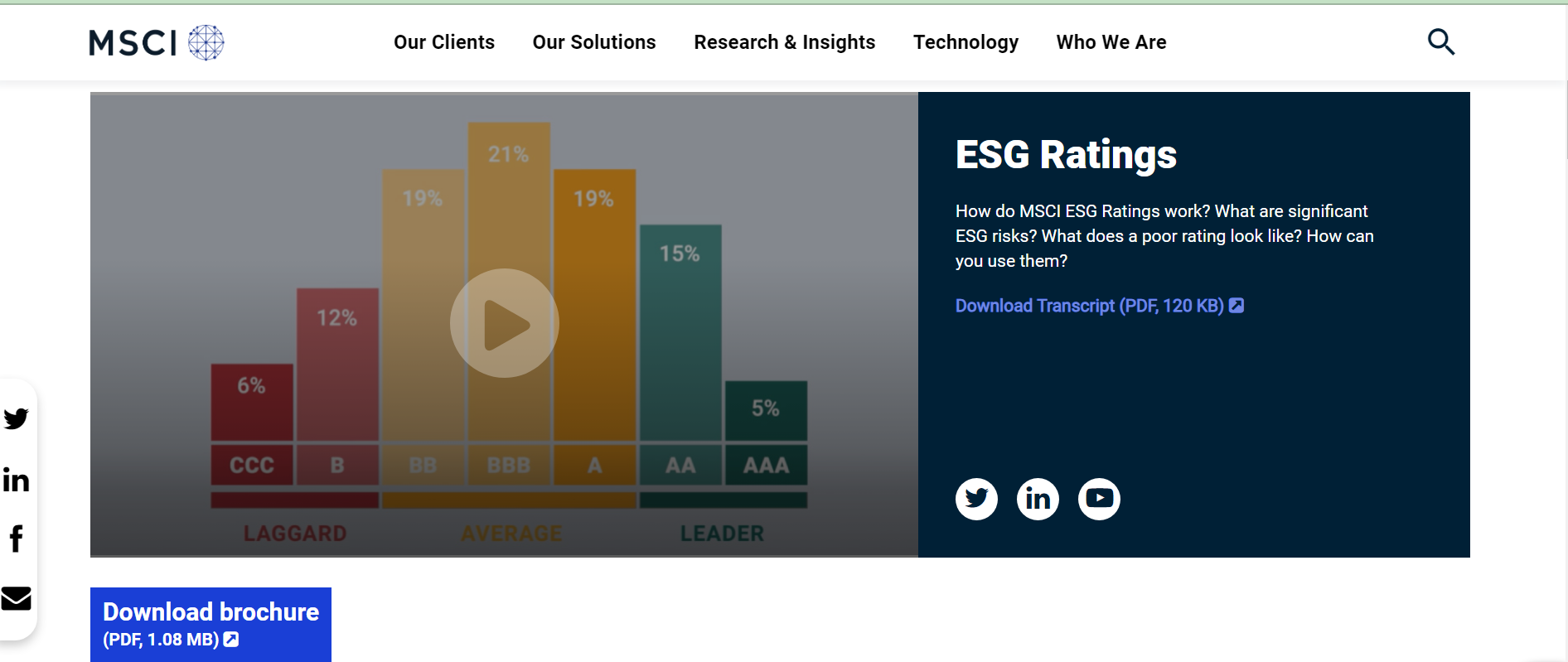

ESG Rating Systems

ESG rating systems serve like Michelin star rating for hotels or restaurants. It’s a way of judging how good a company is when it comes to ESG factors. But instead of looking at comfy beds or tasty food, ESG ratings look at things like how much waste a company produces, whether it pays its workers fairly, or if it’s open and honest about its business practices.

There are many groups that give out these ratings. Some of the big names include MSCI, Sustainalytics, and Bloomberg. They each have their own way of scoring things, so a company might get a high score from one and a lower score from another.

Let’s take the example of Microsoft. In 2020, MSCI gave Microsoft an AAA rating (the highest possible score) for its ESG performance, praising its strong commitments to privacy and data security, as well as its environmental initiatives.

But keep in mind, these ratings are just one piece of the puzzle. They can give you a quick idea of how a company is doing, but if you really want to understand what’s going on, you’ll need to dig a bit deeper. You could read a company’s sustainability report or check out news articles and other sources to get more info.

Also, remember not to rely solely on these ratings to make your investment decisions. ESG is just one part of the equation. Other things like the company’s financial health, market trends, and your own investment goals should also be considered.

To sum up, ESG rating systems can be a helpful tool to start your ESG investing journey. Use them wisely, and they can help you pick out companies that align with your values and financial goals.

Challenges in ESG Data and Reporting

ESG investing seems like a great idea, right? But, like anything in life, it’s not without its hiccups. Here are some of the speed bumps you might face when it comes to ESG data and reporting:

-

Inconsistency: ESG data can be a mixed bag. Different companies might report different things, and even use different names for the same thing! This can make comparing companies a bit like comparing apples to oranges.

-

Lack of Standards: There’s no global rulebook for ESG reporting. This means companies can pick and choose what they report. Some might not report on certain issues at all, making it harder for you to make informed decisions.

-

Greenwashing: Some companies might try to look better than they are by making their ESG efforts seem more impressive than they really are. This is called greenwashing, and it can lead you to make investment decisions based on false information.

-

Data Quality: The data a company reports is only as good as the data it collects. If a company’s data collection methods are sloppy, the data they report might not be reliable.

-

Timeliness: ESG data is often reported annually, which means it can be out of date by the time you see it. This could mean you’re making decisions based on old information.

-

Verification: Not all ESG data is verified by a third party. Without this verification, it’s harder to trust the data a company reports.

To tackle these challenges, you’ll need to be a smart and savvy investor. Don’t take everything at face value. Do your own research, use multiple sources of information, and always ask questions. If something doesn’t seem right, dig deeper. Your wallet – and the planet – will thank you.

Role of ESG Disclosure and Transparency

So, you’re now navigating through the world of ESG investing, however, you may wonder how you can trust the information you’re getting. That’s where ESG disclosure and transparency come in.

ESG disclosure is all about companies sharing information about their environmental, social, and governance practices. Let’s say you’re eyeing a company. You’d want to know how it manages its waste, how it treats its workers, and how decisions are made at the top. A company that’s open about these things is like an open book. It’s easier to trust because it shows it has nothing to hide.

On the other hand, a company that’s not transparent might be like a mystery novel. You might not know what you’re getting until the final pages. That can make investing a risky business. Therefore, seeking companies with good ESG disclosure and transparency can help you make more informed decisions.

Transparency is also important because it can put pressure on companies to do better. If a company knows its ESG practices are being watched, it might work harder to improve them. It’s like knowing your teacher is watching while you’re doing your homework - you’re probably going to do a better job!

Remember, a company that’s open about its ESG practices isn’t just good for investors. It’s good for the planet and the people on it. So, as an ESG investor, favoring transparency and robust ESG disclosure is a win for everyone involved.

The Future of ESG Investing

So, you’ve learned the ropes of ESG investing, and you’re on board for this exciting journey. But where’s this ship sailing to? What does the future hold for ESG investing? Let’s embark on a little time-travel and explore what’s on the horizon.

First, you need to know about the trends shaping the ESG investing landscape. This isn’t a static field. It’s constantly evolving, shaped by things like public opinion, technological advancements, and even the changing climate itself. You’ll see new patterns emerge, like a growing interest in certain sectors or a shift in the way investors assess ESG risks. For example, companies that focus on renewable energy are getting more attention from investors these days.

Next, it is crucially important to understand the role of regulation in ESG investing. Now, this might sound a bit boring - all those laws and policies. They can influence how companies report their ESG practices and how investors evaluate them. So, having an understanding of the regulatory landscape can be a valuable tool for any ESG investor.

Take the European Union, for example. The EU and its Corporate Sustainability Reporting Directive (CSRD) has been at the forefront of ESG regulation, implementing comprehensive policies that require companies to report non-financial information. This includes details about environmental protection efforts, treatment of employees, respect for human rights, anti-corruption, and bribery matters. These regulations help provide a clear picture of a company’s ESG commitments, aiding investors in making informed decisions. Thus, gaining a sound understanding of the regulatory landscape, like that of the EU, can be an invaluable tool for any ESG investor.

Finally, every investor must know if have not known still about the bigger picture - the Sustainable Development Goals (SDGs). These goals serve as a global to-do list to make the world a better place. They include goals such as reducing poverty, improving education, and of course, tackling climate change. ESG investing can play a big role in achieving these goals. By investing in companies that align with these goals, you’re not just making a smart financial move - you’re helping to shape a better world.

And that’s the beauty of ESG investing. It’s not just about the money. It’s about making a difference. So, as we venture into the future of ESG investing, you’re not just a passenger. You’re an important part of the journey. So, strap in and let’s see where this road takes us!